Recent research conducted by Pioneer Group sheds light on the life sciences investment trends shaping the current landscape, offering insights into where capital is being allocated and what it means for the sector. Our Life Sciences Business Reporter, Beckie Barrett, provides further details.

An upturn in the UK market

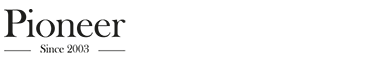

In our previous report, we discussed how the fall in venture capital investment levels over recent years has caused some concern in the real estate sector, though noted the whirlwind of venture capital activity in the year 2021 had somewhat skewed recent data.

According to data in our latest Life Science Market Report, the life science market has experienced a notable resurgence in the first half of 2024, signalling a sustained trend of growth. In the UK, venture investments in Q1 and Q2 reached £491M and £648M, respectively, surpassing the figures from the same periods last year.

Life Sciences Investment Trends: Start Ups

Start-ups are the lifeblood of the life science sector, emerging as the future stars and key occupiers, while ensuring a steady pipeline to offset the natural attrition of businesses over time. Since 2005, Pioneer has been tracking these start-ups using a rolling five-year analysis to spot trends. In the last decade, the number of new companies has more than doubled, showcasing a strong foundation of emerging businesses and a bright outlook for future growth.

Though preliminary data for 2019-2023 suggests a dip from the peak levels of the 2021-22 boom, overall, start-up creation remains strong, averaging 130 new businesses annually, and with venture capital investment levels are on the rise. We are also closely monitoring upcoming UK government policies that could influence the sector.

Regional Dynamics

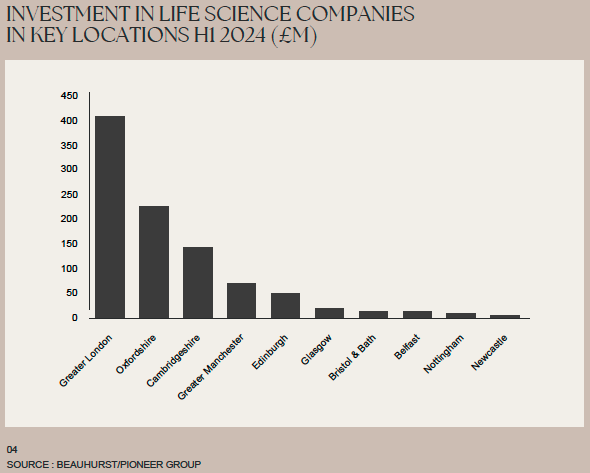

Our analysis reveals that the top ten UK locations (Greater London, Oxfordshire, Cambridgeshire, Greater Manchester, Edinburgh, Glasgow, Bristol & Bath, Belfast, Nottingham and Newcastle) captured 80% of these investments. This share would rise to 87% were it not for the £95M raised by Pheon Therapeutics, whose location in Rothamsted puts it outside the Cambridge cluster.

The concentration of activity in these key regional centres becomes evident when examining the percentage of investment directed towards companies based in each of these hubs. In most regions, over 70% of the investment is funnelled into these main centres, with some areas seeing as much as 100% of the investment concentrated there.

Looking Ahead

In short, our latest report shows that the life sciences sector is experiencing renewed momentum, with a strong resurgence in venture capital investment in 2024, particularly driven by start-up activity. While there has been a modest dip from the peak boom of 2021-22, the steady formation of new companies and rising investment levels indicate a robust foundation for future growth. Regional hubs remain key players, capturing the majority of capital, and ongoing government policies will be critical in shaping the future of this dynamic sector. The outlook remains promising as innovation and investment continue to fuel progress.

Pioneer Group remains committed to monitoring the market and providing insights. Our UK Life Science Market Report now has the benefit of 14 years of data on the creation and funding of life science companies.

Want a Snapshot of the Life Sciences Market?

Our Life Science Market Updates offer a unique insight.